Gilt Crisis Has Everyone Wondering: What Might Break Next?

From The Maven Letter: October 12, 2022

Remember how the Bank of England intervened in the gilts market, buying British bonds to push prices back up and yields back down, so that pension funds that had leveraged their massive gilt holdings had time to find other collateral for those bets?

Ya – it worked for a little while. Emphasis on ‘little’. For example, British real 10-year yields are back above 1%, erasing the change from BoE buying. For context: less than a month ago they were below minus 1%. I outline that shift and time frame because those are incredibly difficult changes for anyone trying to manage money.

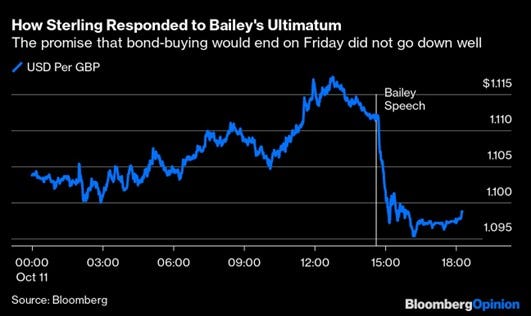

It feels like we obsess over central bank governors these days, to an extent that sometimes seems crazy. But the way our financial world is structured today means their actions matter. BoE Governor Andrew Bailey gave us a solid example of that on Tuesday when he said the bank would stop its brand-new bond-buying program at the end of this week.

Gilt yields immediately rose again, re-attaining their peaks from before the bank intervened, and the pound slid. Cause and effect were very clear:

And fair enough. The BoE intervened to contain systemic financial risk and then, just a few weeks later, said it would no longer contain those risks, which are still clearly present. I get that the bank didn’t want to get stuck buying bonds for an extended period, since it is trying to tamp down inflation and buying bonds boosts inflation, but still.

Many commentators pointed out that the BoE left the market to malfunction despite being the primary cause of the malfunction. And fairly so. It’s been known and discussed for a decade that, after so much bond buying by central banks, there are all kinds of risks now primed should yields suddenly rise.

Remember, bond buying boosts bond prices, which suppresses yields. With central banks buying bonds almost constantly since the Great Financial Crisis, falling yields had become the only trend in the bond world. And so immense pools of money positioned for that.

But when everyone is positioned for the same thing and that thing suddenly changes, watch out. Especially when the thing in question is a massive market of low-risk must-own notes.

This is not a UK phenomenon. This is everywhere. That this crisis is hitting gilts is significant for those invested in the UK market – but also for the questions it is raising about what might fall apart next.

Jamie Dimon is the head of JP Morgan Chase. Much was made of his recent forecast that the S&P might well fall another 20% from here and that the US economy will soon be in a recession. Sure, that was the headline…but he also said this in his outlook:

The likely place you’re going to see more of a crack and maybe a little bit more of a panic is in credit markets, and it might be ETFs, it might be a country, it might be something you don’t suspect. If you make a list of all the prior crises, sitting here we would not have predicted where they came from, though I think you could predict this time that it probably will happen. So if I was out there I’d be very cautious. If you need money, go raise it.

At the end of the day, when financial conditions change quickly, odds are that something will break. That’s what happened in 2008. Back then, a series of instruments that worked in the financial conditions that had prevailed for years failed when those conditions changed. That, my friends, is why people are paying so much attention to gilts: in case the UK crisis is a harbinger of crises to come elsewhere.

I don’t have an estimate of how likely that is. But I know it’s worth watching. A major crisis would change my investment thesis, which sans crisis rests on stepping back into the markets just as soon as the Fed stops raising rates. And that’s the plan I’m sticking with…unless some obscure credit instrument (a la 2008) or a mainstream debt instrument (like government bonds!) leads to a crisis.

This content is available thanks to subscriber support. To subscribe to the full newsletter, see subscription options here or click the button above.

Add the RESOURCEMAVEN30 promotional code at checkout and get 30% OFF!