I realize that the bottom has fallen out, or is continuing to fall out, for all gold stocks. What to do? I remember about a year ago that you mentioned that you bought the stocks of a number of majors when the March 2020 dive occurred. Is that same opportunity for stocks and/or options for the gold majors on the horizon?

- Reader DD

Great question! The short answer is yes. The challenge will be timing, of course.

Gold often recovers first out of a recession. And the recovery can be fast. That’s precisely what we saw in 2009 and in 2020: gold bottomed before the stock market and rebounded more sharply. It made for great returns for those who entered when, to use an overused phrase, there was blood in the streets.

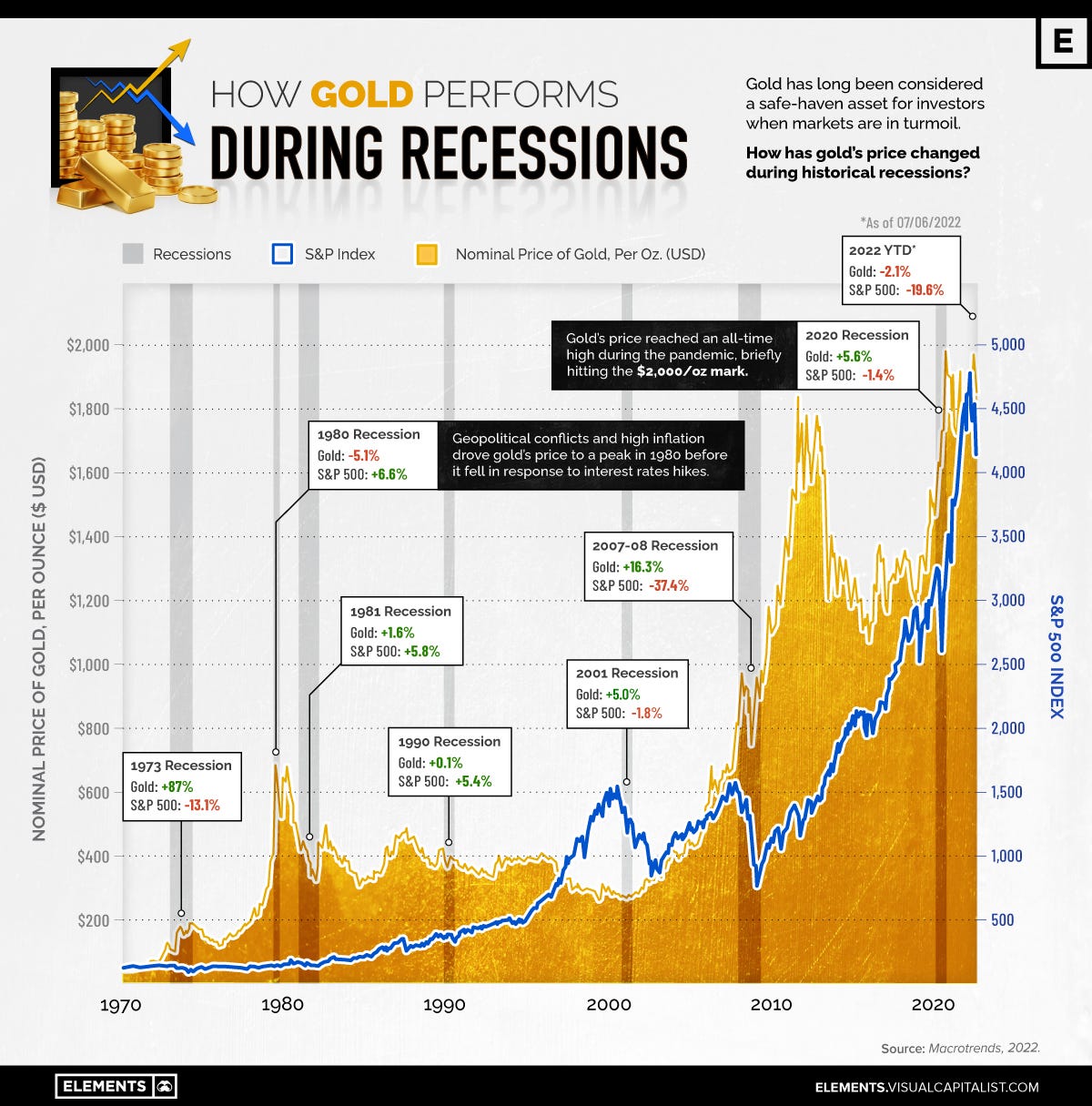

In fact, the idea that gold protects wealth in a recession is really based on its early rebound following a bad period, as opposed to performing well during. Visual Capitalist, who creates great visualizations of all manner of data points (I recommend signing up for its list, which you can do here), just published the chart below, which is a nice capture of gold during recessions.

In most of the recessions shown, gold falls – slides or tumbles – for the first half or more of the recession. That the metal ends the recession in the green is usually because it retakes its losses 8 and more late in the period. Not all recessions follow this pattern – gold gained through much of the 1973 recession, for instance, and lost ground overall in the short 1980 recession – but the pattern is there for most of the grey-shaded areas.

Close inspection also shows gold gaining ahead of the S&P, at least for the recession in the last 20 years (and one can argue that modern analogues matter more, given how much our monetary system has changed).

These patterns are the reason my answer is yes. But they also underline the importance of timing. Look at the GFC: gold gained 18.3% from start to finish, which is great, but it gained 30% from its mid-crisis bottom. The slide-before-rising pattern means gains were far better for those who bought mid-recession than at the start for almost all the crises charted: it was true in 1980, 1981, 1990, and 2020 as well.

I realize it’s not all that helpful to say: yes there’s a buying opportunity ahead but it will work out best if you buy at the bottom. Because obviously and because timing the bottom is hard.

I’m not trying to be glib! The reason I spend so much time on macro is in an attempt to help all of us enter close to the bottom.

If I watch the gold price and the bond market and inflation and jobs and manufacturing and the US dollar and real yields and growth expectations and investor sentiment and liquidity, I stand a chance of seeing the forest for the trees: understanding whether the worst of the storm has passed, in which case it’s time to buy gold majors, or whether there’s more darkness ahead, in which case it’s still early. I cannot promise to get it right. But I will say that it takes a lot of time and thought to sift through the data and I’m happy to do that if it even just improves our odds of entering close to the bottom.

As I noted in the above editorial, I really don’t think we’re there yet. Stayed tuned.

This content is available thanks to subscriber support. To subscribe to the paid newsletter, see subscription options here or click the button below.

Add the RESOURCEMAVEN30 promotional code at checkout and get 30% OFF!