Mega Mailbox: Carbon Streaming, Effects of Inflation, and Diversifying Your Junior Mining Portfolio

From The Maven Letter, April 13, 2022

Gwen Preston answers Maven Letter subscriber questions directly with detailed answers and in-depth research. If you would like to subscribe, please see our subscription options here.

Just wondering when you are going to add a Carbon Streaming Company to your portfolio.

Reader DT

Great question – and one with a big answer.

Whenever I’m asked for my outlook on commodities, my answer always includes The Green Revolution. It’s a paradigm shift in how people live and how businesses operate.

Paradigm shifts always create loss and opportunity. From where I stand, the green revolution is undoubtedly juicing demand for many things mined, from copper and nickel to phosphate and lithium. And it is creating a carbon credits market that is projected to grow ridiculously quickly over the next few years.

I thought I had enough capacity to cover this opportunity within The Maven Letter and via Peter Krauth’s Gold Resource Investor, the metals newsletter he writes under the Resource Maven banner that’s designed for generalist investors.

But a few months ago (a bit later, but at least it happened!) I realized that investment opportunities related to the green revolution deserved their own publication. At the same time, Peter and I agreed that GRI wasn’t working particularly well.

One plus one equals…a new newsletter on investing in the inputs and innovations powering the green revolution. This letter, which might be called Evergreen Investing, will replace GRI sometime over the summer. And carbon credits opportunities will be front and center.

In the meantime, there is one carbon credits streaming company that I have been watching. It will likely come to trade before the new letter launches; if so, I’ll cover it in The Maven Letter until Evergreen Investing (or whatever name we settle on – ideas welcome!) is ready to take it over.

Between the cost of delays, and greatly increasing labour and material/equipment costs for companies building mines, and higher fuel, parts, and labour costs for operating mines, might virulent inflation affect the theses for investing in one sector of the industry vs another sector, differently? Might there also be different effects on mining stock prices depending on the sector because of the change from an almost exclusively risk on market, to a risk on/risk off yo-yo market? If so, what are the mining sectors and specific companies that are likely to benefit most in these times?

Despite the higher risk, I originally concentrated my holdings in the exploration sector, as I expected the greatest bang for the buck when metal prices started moving upwards in a generally risk on market to come from those stocks. Now we have rampant inflation, a major war, increasing societal dislocation, rising uncertainty over supply chains, and apparently incompetent idiots running governments and central banks. Given the more than usually uncertain investing environment, I’m wondering whether it might be wise to reduce exposure to explorers in favour of the mid-tier and major producers, or at least focusing on juniors and explorers with catalysts in the very near term.

There are just too many moving parts for me to make sense of things. Would you care to give your thoughts?

Reader AR

What an astute and complicated set of questions and observations.

Inflation is absolutely impacting the mining sector. The chart below comes from an independent analyst (AuCu Consulting).

The black and red lines, showing cash and all-in sustaining costs, have clearly been rising for two years. This chart came out a few weeks ago and so does not include Q1 of this year, when costs rose again, propelled by energy cost inflation.

Around the same time, AuCu posted this chart, a fellow I know who is CEO of a single-asset gold miner sent me a good example of inflation. He forwarded the note below, sent to him from Cyanco, which supplies his mine with cyanide…and just increased cyanide prices by 30%.

Just today was saw that the Producer Price Index rose 11.2% year over year in March. Raw material costs are ramping higher. This makes it more expensive to run a mine, which relies on fuel and chemicals and tires and mill components and trucks and so on, and it certainly makes it more expensive to build a mine.

The market clearly dislikes what inflation is doing to development costs much more than it dislikes inflation cutting into mining profits. We’ve seen multiple examples of companies putting out updated mine plans with 20 to 30% capex increases compared to a few-years-ago plan and getting punished for it.

Meanwhile, producers, especially major ones, keep trading higher. Newmont, for example, is trading at all-time highs.

I don’t love this market response – we can’t just stop building mines!!! – but I can understand it. Huge capital projects like mines are always financial tightropes: builders never want to take on more debt or dilution than necessary so as to preserve future upside, but that only works if costs remain fairly in line with expectations. Rampant inflation turns that ‘if’ into a major risk. And if a mine builder runs out of money before reaching production, it can trigger a cascade of problems: tack-on debt is more expensive, adding debt can violate rules within the main debt package, investors are likely to exit in case it all falls apart, a weak share price can lead to other problems, and so on.

So I suppose it’s fair that investors are hesitant about mine builders while inflation is raging. They are less worried about producers because of the assumption – generally correct so far – that gold rises with inflation.

The other argument for producers / against developers and explorers is Value versus Growth. We’re at the end of a long period of growth investing. For over a decade, growth was the place to be. Now that’s changing. Investors across the stock market are shifting from growth to value and the rationale parallels the reasons mining investors are preferring producers to developers: inflation is less of a risk to value stocks like utilities, insurance, real estate, and established manufacturing than it is to growth stocks that need investment and debt to keep going.

Gold producers are a value trade. They offer fantastic free cash flow and strong dividends, plus exposure to the uncertainty hedge that is gold. Gold developers and explorers are not value plays: no cash flow, no dividends, no guarantees of success, and reliance on financings to stay afloat.

Let me sum up before moving on:

Costs are rising across the mining space.

Investors are ok with costs climbing at operating mines, likely because gold prices are strong/rising and cash flows are so good. By contrast, investors are not interested in the risks that inflation poses to builders.

Inflation and rising rates and an about-turn in monetary policy to try to slow growth (and thus risks causing a recession) are prompting a shift from growth stocks to value stocks, across the stock market. This shift enhances the appeal of miners over developers/explorers.

So that’s what is right now. The next question is what’s next.

I can’t know, of course, but I have a few ideas.

The chart below is from an investor named Erik Wetterling who writes about this sector under the nickname The Hedgeless Horseman. In a recent video, he used the chart to illustrate how huge the current difference in market response to gold producers versus juniors.

Newmont is up 50% in the last six months. Gold is up 12%. Bear Creek Mining, which THH uses as a proxy for juniors, is down a few percent.

BCM is what we call a ‘deep optionality play’. Bear Creek has a good silver-lead-zinc project in Peru called Corani. Corani is permitted for construction and until mid-December BCM was focused on arranging a $580-million funding package to build it.

Then the company announced a $100-million deal to buy the Mercedes mine from Equinox Gold. Mercedes was a small mine in EQX’s portfolio and so didn’t get the attention it needed to perform well. BCM found support from Sandstorm Gold to buy the cash flowing mine, with the rationale that (1) it can improve the mine through focused attention, (2) it can find more mineralization at Mercedes, also through focused attention, (3) cash flow from Mercedes can help the company through building Corani, and (4) a mine in Mexico diversifies a company that was previously all Peru.

Closing the Mercedes deal is taking a while. Corani is stalled until Mercedes is not only transacted but until BCM feels operational comfort. The investment thesis rests on BCM being able to make Mercedes into a bigger, longer-lived mine than it is and being able to build Corani in an inflationary world that needs more silver. It all means BCM is a deep optionality play, a stock that could do exceptionally well if things work (Mercedes closes and improves, BCM secures a good funding package for Corani and builds it despite inflation pressures) but that could fumble along if things don’t work out.

I’ve given these details on Bear Creek to explain why THH used it as a proxy for junior explorer/developers. It makes sense. If things go well for juniors – if one makes a discovery, sure, but also if investor interest in metals rises enough that money starts to flow down to juniors, creating a tide that lifts all boats, and that lift enables more exploration and development that creates more successes – juniors in this space could do exceptionally well.

I don’t say “exceptionally” lightly. The chart above goes back to 2012. You can see that juniors, using BCM as a proxy, haven’t gained much ground yet in this bull market. Lots of juniors are still close to 52-week (or even five-year) lows, a stellar gold price be damned. Meanwhile, Newmont is trading higher than ever.

I outlined above why I think juniors are not yet performing. Those reasons are real. Yet the gap – Newmont trading up, up, and away while juniors stay on the bottom – can’t persist.

So what should one do?

Remain in strong explorers, because discoveries pay no matter what.

Own major producers, because big money will continue to flow into big gold.

Buy companies with mines that are almost built (Orezone, Altaley), because they are largely past the CAPEX inflation risk and could enjoy outsized re-ratings as they join the ranks of producers.

Probably avoid companies setting up to build mines unless you have very strong confidence in the takeout potential or the management team is known in particular for exceptional cost management (such as the Steven Dean-led team at Artemis Gold).

But also remember that the only constant is change. I don’t know when enough interest will turn to gold, or mined commodities in general, that money will start flowing down to juniors and closing that gap, but it will happen. So I also own some ‘boring’ companies, like Newcore and Osino and Montage, even though they are approaching builds and aren’t performing yet, because they should be among the first to rise when the gap starts to close.

And I like to diversify. As it turns out, I was also asked about diversification in a mining portfolio…see the next question!

People to talk about how important it is to have diversification in your overall portfolio. I’m not sure I’ve ever heard anyone discuss a good diversification plan in terms of a metal portfolio, so to speak.

Reader CG

With a mining portfolio, diversification involves two axes: asset stage and commodity.

How one’s portfolio should spread along the first axis depends on your risk tolerance and time commitment. If you are ok with risk and are willing to put in the time to learn some geology and follow company news, then explorers and developers make sense for you. If you do not like risk and aren’t inclined to put much time into your mining portfolio – that’s ok, but it means you should play larger companies and funds of miners.

Those reading this letter are all interested in juniors – you subscribe because you like the upside opportunity that comes with risk, you know enough about exploration and geology and mining markets that some stocks stand out and others look terrible, and you follow news with some regularity. That’s great – but it doesn’t mean you should only own pre-discovery explorers.

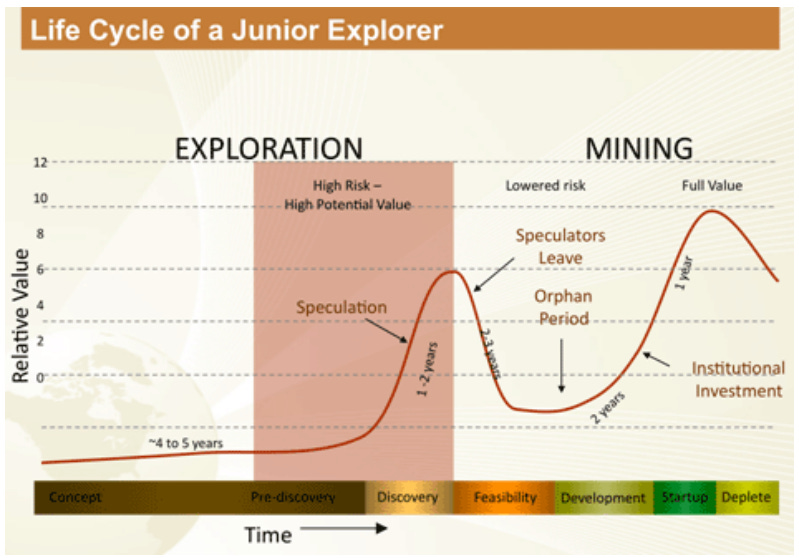

We can all get influenced by experiences. That I’ve done well on a few early-stage explorers who made significant discoveries inclines me to such stocks. But explorers will always be the riskiest of investments. Most explorers do not work out well. By contrast, there are more guaranteed gains available with companies turning recent discoveries into initial resources and mine plans (truly creating value with the drill bit) or building mines around well-studied deposits (the Golden Runway re-rating). The Lassonde Curve paints the picture well.

So even investors who enjoy junior explorers should also have some more advanced opportunities in their portfolios. I try to model this with my $200,000 portfolio, though I failed to take my own advice sufficiently this year – performance year-to-date would have been better had I some producers in there!

Then there’s the other axis: commodity. Here the concept is that different metals stand out at different times. In another nice paint-the-picture, the chart below shows how ScotiaBank’s analysts see base metals today.

I would put gold and silver in the same general vicinity as copper and uranium. Thermal coal is still peaking, with the potential for a plateau at strong levels as a shift away from Russian energy sources increases demand. Fertilizers are also on the upswing, perhaps approaching the top of the first peak (prices have already gained significantly in 8 months) but with potential for a shallow valley ahead as food insecurity becomes a defining issue in the years ahead.

The point is that different mined commodities perform at different times. There are two ways to try to have exposure to the performers at any given time: try on a regular basis to create a chart like the above and adjust your portfolio accordingly or have exposure across metals that you like overall and not worry about the ebbs and flows.

The former can generate higher profits…but only if you get it right. And it’s not easy. Who, for instance, would have predicted that zinc would have gained almost 50% in the last six months?!? Or that silver would have traded only sideways for the last two years while gold climbed? I certainly wouldn’t have forecast this as the met coal price chart for the last two years:

You can probably guess where I’m going with this: if you believe we are in a commodities bull market, position across the mined commodities that you like. I like gold, copper, uranium, silver, fertilizers, and coal. I hold positions in all of those with the understanding that macro moves could upset one or several areas for a time.

A near-term recession, for instance, would damage copper, silver, fertilizers, and coal. I can’t know whether that will happen, but I do think that the fundamentals of each market are strong enough that any damage would likely be short-lived. And so rather than trying to predict a recession or trying to exit certain metals with an intent to re-enter at a bottom, I plan to hold through, potentially adding to positions should a correction create opportunity. (Gold and uranium would also be impacted but to a lesser extent.)

So: a diversified mining portfolio has a range of stock/project stages (a range appropriate to the investor in question) and has exposure to all of the commodities that the investor believes have bullish fundamentals. Easier said than done…!

This content is available thanks to subscriber support. To subscribe to the paid newsletter, see subscription options here or click the button below.

Use the RESOURCEMAVEN30 Promotional Code during checkout if you’re a new subscriber and get 30% OFF!

In your answer to the question about diversification, would it not have been appropriate to add jurisdictional risk on a third axis?